The Ecofin Sustainable Listed Infrastructure UCITS Fund aims to achieve a high, secure dividend yield on its investment portfolio and to realise long-term growth in the value of the portfolio while taking care to preserve capital.

Fund Stats as of 25/07/2024:

NAV

€112.36

NAV Change

€-0.48

Legal Structure

UCITS

ISIN

IE00073SD237

Distribution Policy

Accumulating and Distributing

Base Currency

EUR

Management Fee (Founders, Share Class for Institutional Investors)

0.60%

Minimum Investment (Founders, Share Class for Institutional Investors)

€2,500,000

The Ecofin Sustainable Listed Infrastructure UCITS Fund invests globally in the equity securities of growth-oriented economic infrastructure companies which are delivering increasing cash flows. The portfolio is diversified with respect to geography, sub-sector and investment themes, and it has a positive impact given the strategy’s focus on sustainability.

Produced by MSCI ESG Research as of 30 June 2024

Produced by MSCI ESG Research as of 30 June 2024

Strategy highlights

- Investment in growth-oriented economic infrastructure companies whose shares are listed primarily on recognized stock exchanges in Europe (including the UK), North America and other OECD countries

- Up to 10% of assets may be invested in companies with equity securities listed on stock exchanges in non-OECD countries

Ecofin believes that companies with a thorough understanding of, and strategy around, environmental, social and governance (ESG) issues are more capable of mitigating risks and enhancing their performance over the long term. Knowledge of ESG factors and risks and active ownership are, therefore, integral to the investment philosophy and process.

Business segments

Electric & Gas Utilities: Generation, Transmission & Distribution of Electricity, Gas and Liquid Fuels and Renewable Energies

Transportation: Roads, Railways, Ports and Airports

Environmental Services: Water Supply, Wastewater, Water Treatment and Waste Management

Process

Investment process integrates traditional detailed fundamental analysis and a thorough study of ESG factors which we believe may affect stock valuations and shareholder value.

Portfolio

Portfolios typically comprise of 40-50 holdings, each 1.25% to 5.0% of the total portfolio. Holdings do not exceed 8% of the portfolio by value and turnover is typically low.

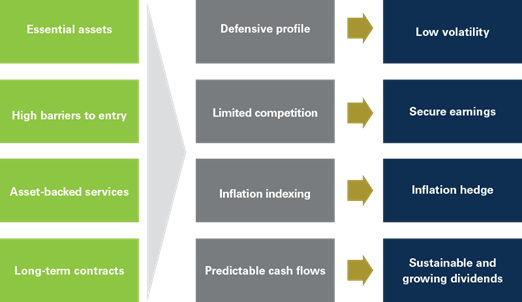

Characteristics of investment universe

Economic infrastructure offers unique characteristics that make it an attractive asset class for investors

Fund Information

As of 30/06/2024

Base Currency

EUR

Legal Structure

UCITS

Portfolio Manager

Ecofin Advisors Limited

Minimum Investment (Retail)

€1,000.00

Minimum Investment (Institutional)

€250,000.00

Minimum Investment (Founders, Share Class for Institutional Investors)

€2,500,000

Management Fee (Retail) 1

1.25%

Management Fee (Institutional) 1

0.85%

Management Fee (Founders, Share Class for Institutional Investors)

0.60%

Distribution Policy 2

Accumulating and Distributing

Redemption Settlement

3 Business Days

Launch Date

23 February 2022

ISIN (EUR, Founders, Accumulating, Share Class for Institutional Investors)

IE00073SD237

Currencies

EUR / USD / GBP

Fund AUM

€2.0M

Administrator

Société Générale Securities Services, Sgss (Ireland) Limited

ISIN (EUR Share Class, Institutional)

IE000CZWNPK5

Non-founder classes, per annum on the net asset value of the fund.

Total expenses do not exceed 1.6% for the institutional and 2% for the retail share classes.

For distributing shares, dividends will be declared and distributed quarterly

Portfolio Exposure (% of NAV)

As of 30/06/2024

Top 10 Positions

| Company | % of Total |

|---|---|

National Grid PLC | 6.4% |

NextEra Energy, Inc | 6.3% |

American Electric Power Co Inc | 4.3% |

SSE plc | 3.9% |

Enel SpA | 3.8% |

| Company | % of Total |

|---|---|

Edison International | 3.7% |

Constellation Energy Corp | 3.6% |

RWE AG | 3.5% |

Enav SpA | 3.4% |

E.ON SE | 3.2% |

Top 10 Positions as % of Investment Securities 42.1%

Net Performance as of 30/06/2024

| Date | Class/Name | QTD | Calendar YTD | 1 Year | Since Inception |

|---|---|---|---|---|---|

| 30/06/2024 | Ecofin Sustainable Listed Infrastructure (EUR) | 2.88% | 6.48% | 2.42% | 9.30% |

| 30/06/2024 | S&P Global Infrastructure Index (EUR) | 3.11% | 6.65% | 7.87% | 16.29% |

NAV performance in EUR.

Performance data quoted represents past performance of ESLIF; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Returns may increase or decrease due to currency fluctuations. Performance includes the effect of costs (including the management fee) which are capped at 1.35% per annum for Founder investors.

Net Performance as of 30/06/2024

| Date | Class/Name | Calendar YTD | 1 Month | 1 Year | Since Inception |

|---|---|---|---|---|---|

| 30/06/2024 | Ecofin Sustainable Listed Infrastructure (EUR) | 6.48% | -4.49% | 2.42% | 9.30% |

| 30/06/2024 | S&P Global Infrastructure Index (EUR) | 6.65% | -1.78% | 7.87% | 16.29% |

NAV performance in EUR.

Performance data quoted represents past performance of ESLIF; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Returns may increase or decrease due to currency fluctuations. Performance includes the effect of costs (including the management fee) which are capped at 1.35% per annum for Founder investors.

*The fund commenced operations on 23 February 2022.

Source: Bloomberg for S&P Global Infrastructure Index (SPGTIND)

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Returns may increase or decrease due to currency fluctuations.

Ecofin Sustainable Listed Infrastructure UCITS Fund ESLIF

Ecofin Sustainable Listed Infrastructure UCITS Fund 2Q 2024 Commentary

IMPORTANT DISCLOSURE

The Irish domiciled Ecofin Global Sustainable Listed Infrastructure UCITS Fund ("ESLIF") was launched in February 2022. A clone of ESLIF launched under Luxembourg domiciliation ("Lux fund") in August 2019, which is now liquidated. ESLIF is managed by Ecofin Advisors Limited to the same strategy as Lux fund but the Lux fund’s performance and portfolio information provided in any fact sheet does not constitute ESLIF’s performance as it is provided for background information purposes only.

ESLIF is passported for distribution in the UK, Ireland, France, Norway, Denmark, Sweden, Finland, Spain, Italy, the Netherlands, Germany and Ireland; access to information on this Fund is not intended for prospective EU investors outside of these jurisdictions other than under a local regulatory exemption.

Information on this website is provided by Ecofin Advisors Limited ("Ecofin UK"), in relation to this Fund in respect of which Ecofin UK manages the portfolio.

Ecofin UK is a leading investment management advisor within the Ecofin family, specialising in sustainability and impact investing globally across the energy transition value chain. It has been FCA regulated since 1992 and SEC registered since January 2006.

Office: London